An overview of automotive wiring harness industry trends

1. Electrification trend The penetration rate of new energy vehicles has increased significantly

New energy vehicles have entered a period of rapid penetration. Domestic auto manufacturers have urgent needs to achieve industrial transformation, and the goal of electrification is clear. Domestic auto manufacturers have set new energy penetration targets, among which BYD sold 104,338 passenger cars in March and the electrification rate; Dongfeng strives to fully realize electrification by 2024; and China FAW strives to fully realize electrification by 2030.

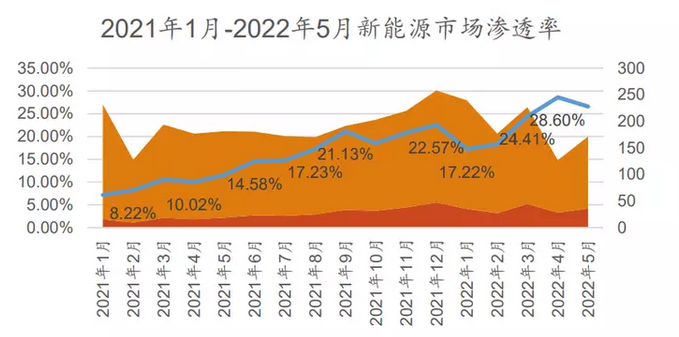

The penetration rate of new energy passenger vehicles depends on the combined action of demand, supply and policy ends. According to the data of the Passenger Federation, the penetration rate of new energy vehicles from January to May 2022 has reached 23.4%, which has achieved in advance the goal proposed by The General Office of the State Council in the New Energy Vehicle Industry Development Plan (2021-2035), that by 2025 the sales volume of new energy vehicles will reach about 20% of the total sales volume of new vehicles. On the whole, the new energy market has maintained a high growth vitality at present, no matter from the purchase intention of consumers, the electrification goal of automobile enterprises, the ability to launch new models, and the support of policies for the new energy market. In 2021, the annual penetration rate of new energy vehicles reached 13.4%, in the first five months of 2022, the penetration rate has exceeded 20%, and in June, the retail penetration rate of new energy vehicles has reached 27.4%. If the current high growth trend is maintained, the penetration rate of new energy vehicles may reach 30% in 2022 and 40% in 2025. However, the penetration rate of new energy vehicles is still variable due to the price increase pressure of upstream raw materials, chip shortage, the end of policy subsidies, the decrease of demand for passenger cars, and the elimination of local auto brands brought by technological update and iteration.

2. Intelligent trend The rapid development of intelligent driving

The development of new energy vehicles is not only the replacement of the energy supply of vehicles, but also the gradual iteration of intelligent to non-intelligent. The "Intelligent Connected Vehicle Technology Roadmap 2.0" promulgated by China further defines the development line: by 2025, the market share of PA(partially autonomous driving) and CA(conditional autonomous driving) intelligent connected vehicles will exceed 50%, and HA(highly autonomous driving) intelligent connected vehicles will realize commercial application in limited areas and specific scenarios; By 2030, the market share of PA and CA class intelligent connected vehicles will exceed 70%, and the market share of HA class intelligent connected vehicles will reach 20%, which will be widely used in expressways and large-scale application in some urban roads. By 2035, the technology and industrial system of scheme intelligent connected vehicles will be fully completed in China, the industrial ecosystem will be sound and complete, the vehicle intelligence level will be significantly improved, and the HA class intelligent connected vehicles will be put into large-scale use.

Driven by the policy, the penetration rate of L2 intelligent connected vehicles is expected to achieve a rapid increase. As driving automation is upgraded, the number of environment-sensing sensors on bikes, such as on-board cameras, ultrasonic radar, millimeter-wave radar, and lidar, continues to increase. At present, the domestic intelligent driving is still in the stage of commercial exploration, and many intelligent driving exploration leaders have emerged in various fields, injecting vitality into the development of intelligent. In terms of autonomous driving chips: In 2019, Qualcomm launched a new generation of intelligent cockpit chip product, a 7nm process engine chip SA8155P, which was mass-produced globally. It has been equipped with Xiaopeng P5, Weimar W6 (parameter picture), ET7 and ET5, Na U Pro, Zero Run C11, Mocha, Macchiato and latte models of Great Wall WEY, Geely Xingyue L, Cadillac Raige and other models; In March 2022, Nvidia's automatic driving chip DRIVEOrin was officially mass-produced. At present, its Xavier and Orin chips have been supplied to most mainstream Guangzhou vendors such as Xiaopong, Nio, Didi, Volkswagen (VLKAYUS), Toyota (TMUS) and Daimler (DDAIFUS).

Previous:New energy SUV sales list rele...

Next:Under the tide of new energy a...